Solana’s stablecoin volume on decline, is this a slow death indicator?

Since the active president of the United States, Donald Trump and his wife, the first lady, launched memecoins to exploit the degeneracy of crypto gamblers, Solana has been on an ecosystem-wide decline.

This was the top signal for memecoins, some would say.

A little memory refresher. Solana is a high-performance blockchain, by popular definition and it is powered by a proof of history(PoH) consensus mechanism. SOL is the native asset and governance token of the Solana blockchain currently valued at $88.62 billion market capitalization.

But…

Solana is not best known for being a high-performant chain, it's not popular for running on proof of history consensus algorithm either, at least not for the regular, every day users, no, no.

Solana is best identified as the blockchain where memecoins thrive. It's a literal casino central where once a while, a not-so-random memecoin surges to billion-dollar valuations and a couple of insiders and very limited lucky degenerates get rich.

Given that the game is designed to profit the house, even though ecosystem’s top voices would want you to believe it's all random, organic and fair, there's been numerous cases of rugpulls and scams that the players were bound to get exhausted at some point.

This point happens to have been the month of January, 2025, as on-chain data suggests.

Stablecoin Volumes: 2024

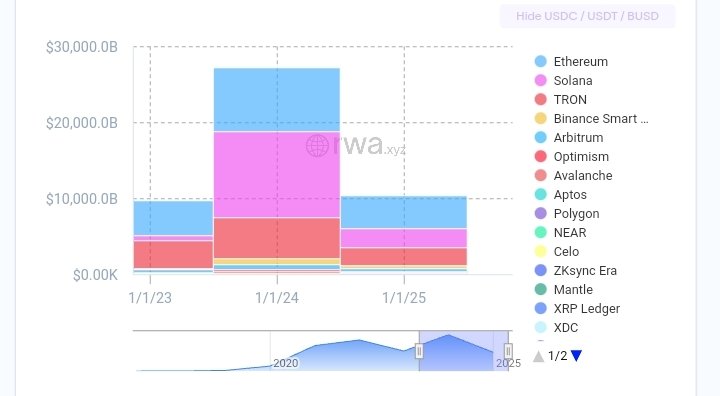

The year, 2024 was a big year for stablecoins. $27.16 trillion was settled on-chain through stablecoins.

As seen in the chart above, from RWA.xyz, Solana led this volumes growth, accounting for $11.37 trillion of the year's generated volumes, $2.99 trillion larger than Ethereum's stablecoin volumes in the same year at $8.38 trillion as the second blockchain with the most volume.

In late 2024, precisely in December, Solana’s stablecoin transfer volumes was $2.23 trillion and Ethereum's was 872.69 billion.

This means that Solana had $1.35 trillion more volume than Ethereum and that's insane to think about, especially since Ethereum's stablecoin supply is 10x larger than Solana’s.

In literal numbers, Solana has $10.9 billion stablecoin supply and Ethereum has $128.2 billion.

Generating far more volume with 10x less supply in the economy is a great stretch of a limited capital.

Moving on.

Stablecoin Volumes: 2025

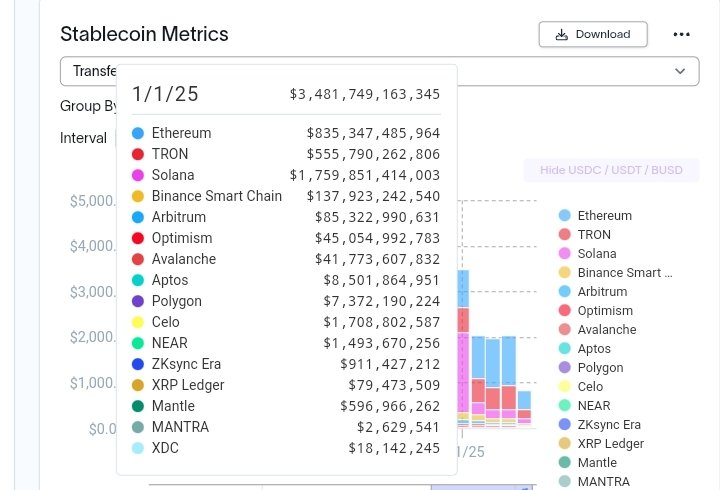

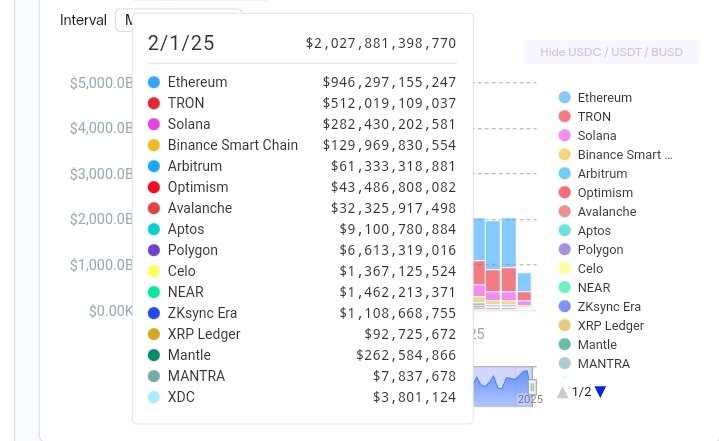

This is a monthly chart and as you see above, January, 2025 was a big month for Solana’s volumes as it saw $1.75 trillion in stablecoin volumes, almost $1 trillion larger than Ethereum's volumes in the same period.

However, what happened in February was absolutely terrible.

Evident in this chart, Solana’s stablecoin volumes dropped to $282.43 billion.

This is a -83.87% volume crash, or $1.46 trillion decline in volume.

Since then, both Ethereum and Tron has led stablecoin volumes and Solana’s volumes has consistently declined.

Is this a slow death indicator?

Judging from Solana’s $1.75 trillion volume in January, recent decline is indicative of a what might indeed be considered a slow death as retail gamblers are consistently exiting the SOL ecosystem.

Solana’s stablecoin volumes are very much reflective of the chain’s health as an economy given that memecoin traders actively move USDC on the chain for memecoin purchases.

The chain added $3 billion in stablecoins supply in January alone due to memecoins trading, according to cryptoslate.com report.

With volumes dropping sharply, Solana is suggestively on a slow death until some new memecoin pops up as the chain isn't very favored by any other thing, not even the growing real world assets (RWAs) tokenization.

Posted Using INLEO

Down with the memes, and in with productive DePIN projects like Helium, Hivemapper, and more.