Making tokenized RWAs active liquidity for crypto is still underexplored

Everyone is talking about the tokenization of real world assets (RWA) but it appears that nobody is actually capitalizing on it despite billions already being tokenized.

I've personally contributed my share of speculation on the “liquidity” that would come with institutional players tokenizing their assets onchain. But the reality is that it isn't pretty straightforward, especially when traditional companies are involved and will be seeking maximum claim of control positions for maximizing profits atop of all issued tokenized RWA.

When you give assets like stocks a space on a blockchain through tokenization, you don't automatically “earn” liquidity, you only just expand data stored in the distributed ledger and the stocks remain traditionally controlled and beneficiary.

All tokens are just data on a chain of blocks(more data). Without deliberate development of “DeFi-centered” solutions around Tokenized-RWA, they just turn out to be blockspace and ecosystem trend leeches.

When traditional institutions talk about tokenizing assets they manage, I imagine that they often play to the idea that this adds a new layer of “service” that introduces new opportunities for taxation(fees) on their clients and also, the increased risks of “self-custody” adds potentials for rewarding the issuing companies as lost assets cannot be redeemed and that essentially becomes a permanent AUM(liquidity leverage) for them.

A game of central interest

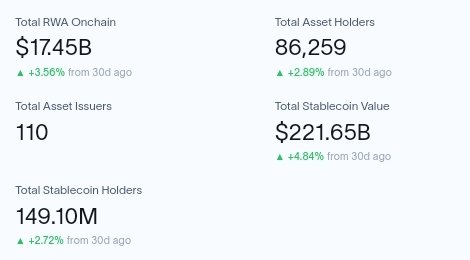

Tokenized real world assets(RWA) have attracted $17.45 billion as seen above. With only 110 issuers and 86.259k holders, this is still a largely underexplored segment of the blockchain investment ecosystem.

Interestingly, stablecoins, which are not often identified as "real world assets" are in fact, exactly that. Of a surety, there's a distinction between an asset and a national currency but if we look at things like bonds, which are essentially "yeild bearing" currencies, that idea of isolating currencies becomes flawed.

Given this reality, the real value of tokenized real world assets is closer to $240 billion. Evidently, these are impressive numbers, especially when we consider the number of stablecoin holders as seen above to be over 149 million.

These are the real money maker, not just for the institutions issuing them but also for the blockchains they function on. Unlike the tokenized real world assets getting the attention of the media, stablecoins, even the centralized ones, are net positive for the ecosystem simply because they are liquidity injection, by default.

To prove this, we can simply look onchain and see that unlike stablecoins, every other RWA are not contributing much to the ecosystem other than taking up blockspace.

Private credit and US Treasury debts makes up majority of tokenized real world assets according to data from RWA.xyz.

Both are just tokenized exposure to the United States dollar, by proxy, making it not much different from stablecoins asides the traditional yield associated.

Everything is central serving, meaning that it's all of best interest to the issuing institutions with not much economic benefits to the cryptocurrency ecosystem.

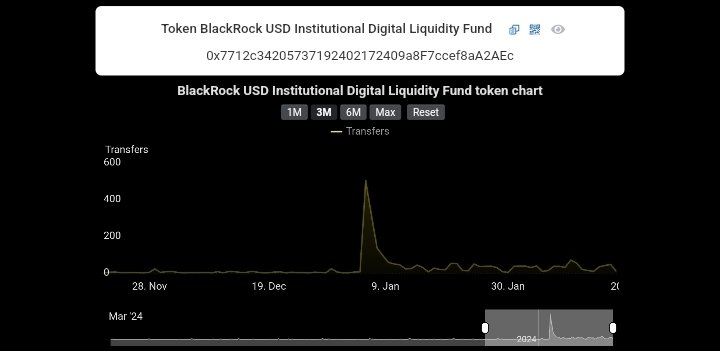

To prove this, let's look at one of the most popular tokenized RWA, BUIDL, issued by BlackRock.

Both screenshots show the reality of tokenized real world assets and the opportunity that lays in wait to be capitalized on by DeFi developers.

Blackrock TRWA, BUIDL is worth over $399 million but it isn't actively traded, any way, hence creates little to zero liquidity value to the crypto ecosystem.

This is also the case for most tokenized RWA at the time. We're yet to make any of it liquidity sources to strengthen the ecosystem.

Without developing the necessary incentive solutions to enable tokenized real world assets become active liquidity, the onboarding of trillions of dollars into the crypto economy will yield little value for the ecosystem.

Certainly, these tokenized real world assets requires a layer of trust that issuing institutions actually have every associated assets under management.

We either figure out how to develop a system where we can verify off-chain reserves and turn tokenized RWA into active liquidity or we don't and essentially enable traditional companies run their usual scam, enriching themselves atop of the industry in the process.

Posted Using INLEO