Is Solana a dead chain without Memecoins? Here's what data reveals

One minute you're a highly praised president by top American figures, the next minute you face possible impeachment for fraud.

Welcome to the new normal, brought to you by Solana.

Motto: You can just scam people.

That simple yeah? We have billion-dollar stories to back it all up, but is this all Solana is?

A shitcoin casino?

No?

My bad, Memecoins Casino. Yeah, because there's truly a “unique difference” there — pay some attention, non-degenerate gamblers.

For context, Argentine President Javier Milei is embroiled in a significant cryptocurrency scandal involving the memecoin $LIBRA. On February 14, Milei promoted $Libra memecoin through his social media channels, describing it as a private initiative aimed at stimulating Argentina's economy by funding small businesses and startups. This endorsement led to a rapid surge in the token's value, with its market capitalization briefly exceeding $4 billion. However, within hours, the token's value plummeted because insiders pulled the plug extracting $87 million+(reportedly), resulting in substantial financial losses for regular investors.

This is a heavily debated event in crypto twitter right now and I've personally tried to stay out of it but something caught my attention.

The rugpull of Libra seemed to have been a wake up call for even Solana-lovers to realize that the chain has been a great disadvantage to the cryptocurrency ecosystem and fresh arguments of its negative impact flooded major discussions on X.

Following this, the loyalists that can't seem to see the problem, ever, came to Solana's aid by posting shits like:

"Blaming Solana for grifters is like blaming email for the $2.9 billion lost due to phishing last year"

I even posted a thread screenshot of it because the subsequent replies where quite hilarious.

Do I agree to the above statement?

Of course not. This comparison is flawed because it compares Solana(a niche chain) to a generic technology — email.

Email has no niche-branding, it's just email. Now when you say "Gmail" now that has niche identity.

Similarly, Solana, though a crypto/blockchain technology, has a niche branding and for as long has I can remember, memecoins have been the branding and that is grifters playground.

That said, these loyalists arguments are simply trying to say that Solana is more than memecoin rugs(and not responsible), but how true is this? Let's look at some on-chain data.

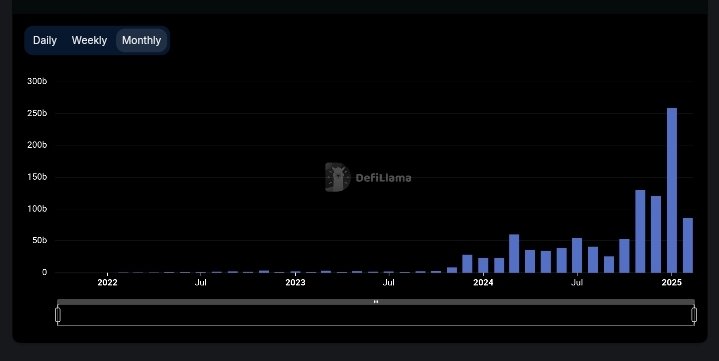

What you're looking at is Solana dexes trading volume overtime from Defillama.com.

What are you supposed to make of this chart?

Evidently, trading volumes were far lower than they are right now through 2022 and 2023. Solana dex trading volume spiked in late 2023, November specifically when it went from being $2.88 billion the previous month to hitting over $8.07 billion. In December, this grew to $28.13 billion and it peaked in January 2025 when it blew through $258 billion.

Unlike 2025 volumes that can partly be attributed to the general increase in the value of crypto assets which influences the value of trading volumes, 2024 volumes were pretty impressive numbers.

But, what really does this have to do with anything?

Well, let's go back to November 2023, when volumes grew to over $8 billion, what happened there?

It would interest you to know that Solana was all about memecoins in 2023. Most of the popular names Pepe, Dogwifhat(WIF), Myro, etc, which all reached over $300 million to over $3 billion in market capitalization all launched in 2023.

This suggests that the lower volumes between $1-$3 billion leading up to November, were most likely fueled by memecoin launches.

November specifically saw the launch of Dogwifhat and Myro, and probably more memecoins I can't dig up at the moment. Myro reached over $300 million in market capitalization and Dogwifhat reach over $4 billion.

November also brought significant gains to several other memecoins launched prior to this time including Pepe, BONK (largest gainer with 974% price surge) and SOMA — the memecoin reported to be the first ever memecoin on Solana.

It became clear that memecoins were a huge success for the Solana ecosystem and guess what happened next?

Pump.fun was released in January 2024 making the process of launching a memecoin less technical and as seen in the chart, volumes grew to significant levels, peaking in March at $59.79 billion.

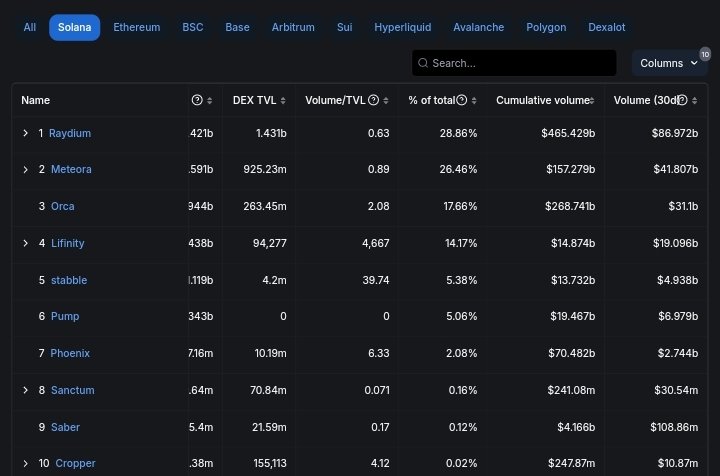

Top DApps exposes the money flow

When you look at what tokens are contributing to volumes on these DEX applications, you see that Solana is simply, as advertised, shitcoin central. Just look at recent 24hrs volume on Rayduim as reported on coinmarketcap.com, it is dominated by memecoins.

The only reason tokens like SOL and the stablecoins there receive significant volume is because they are either used to buy into memecoins or memecoins are sold back into them.

If memecoins went away, Solana would suffer significantly because utility projects(if any) on the chain aren't receiving much attention. Essentially, saying that Solana is a dead chain without memecoins would be an accurate assessment and also saying that the chain is responsible for the extraction of gullible and greedy crypto folks would also be accurate.

The entire ecosystem has deliberately branded itself that way. From wallet softwares to analytic tools and decentralized exchanges, all have used memecoins as a way to drive conversations on social spaces, effectively making it their branding and marketing rail.

Solana is sustained by memecoins, this is no rumor, just facts.

Posted Using INLEO

https://www.reddit.com/r/Kryptostrassenwetten/comments/1it965o/solana_und_milei_da_gehen_die_wogen_hoch_is/

The rewards earned on this comment will go directly to the people( @blkchn ) sharing the post on Reddit as long as they are registered with @poshtoken. Sign up at https://hiveposh.com. Otherwise, rewards go to the author of the blog post.