ETH shorts hit new highs; fear? conviction or Wallstreet manipulation?

Looking over the data, my first line of thought is that an attempt to takeover Ethereum is happening in real time.

Certainly, it's becoming increasingly unclear who exactly wants to do that, the concentration of liquidity to centralized exchanges makes it difficult to determine what exactly is going on behind the scenes.

I haven't really kept up with ETH developments as it's been mostly boring with every chain upgrade hypes claiming to be the step forward that fixes the network's scalability issues and every single time, it fails.

Notwithstanding, I'll try to highlight a couple of things that have happened recently that I believe show raise a few eyebrows.

First off, I've always considered ETH to be centralized. The chain has always moved in the direction that benefits VCs, it isn't that hard to figure out. I already pointed out in my last post specifically discussing Ethereum and significant role layer 2 developments have played in why ETH has underperformed, price-wise. There's a good chance ETH would be trading near Bitcoin's price — at least 10x of current price if L2s never happen.

If you doubt this, maybe add up the market capitalization of the numerous L2s that exist to ETH’s marketcap and see how it sums up. L2s have redirected liquidity from Ethereum and made it less appealing to retail. People don't get it, but retail is responsible for taking asset prices to new highs, especially crypto. Institutional investors don't pump the market, they buy slow. Matter of fact, they go as far as creating FUD to buy in cheaper.

Institutional traders may pump the market but those are often short-lived pumps as they are often bull traps for quick profits.

Moving on, what's really going on with Ethereum lately? I'll dive in with what's most recent.

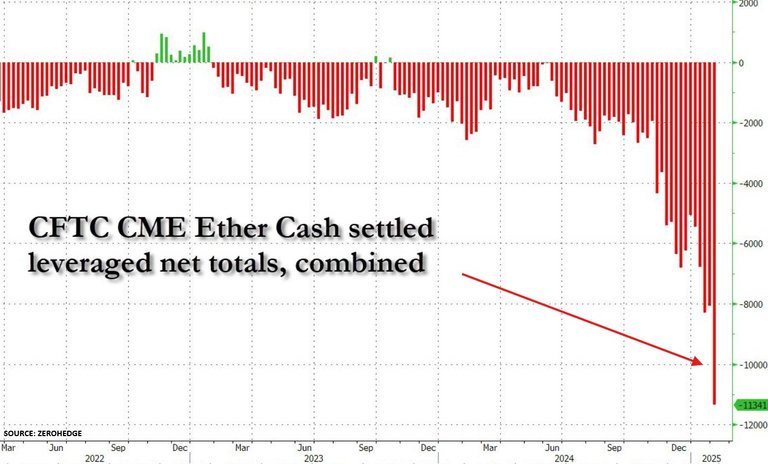

ETH Shorts have grown 500% since November 2024

Most recent reports reveal that ETH short sellers volume has grown by 40% in one week, also highlighting that the asset has attracted +500% more shorts since November 2024.

This was reported on X by The Kobeissi Letter.

What's interesting, and also noted by the report is that ETH inflows have remained high despite recent FUDs and shorts spikes.

Interestingly, even as short exposure was ramping up in December 2024, Ethereum inflows were HIGH.

In just 3 weeks, ETH saw +$2 billion of new funds with a record breaking weekly inflow of +$854 million.

These figures(slightly higher) were also reported on Cointelegraph in Feb. 09.

Data resource CryptoQuant showed Ethereum accumulation addresses receiving 330,705 Ether worth $883 million—the highest ever in a day. As a result, the total ETH held by these long-term holders reached a record 19.24 million.

I reckon that it's quite interesting that long-term holders control that much supply, which is near the amount held by exchanges.

As of today, exchanges hold approximately 19.063 million ETH, worth over $50.79 billion.

Speaking of inflows, traditional investment channels in ETH have also attracted quite the value in recent times.

According to data from SoSoValue, the nine spot Ethereum ETFs recorded $420.06 million in net inflows over the past week, marking the first time they have surpassed the net inflows of their Bitcoin counterparts over a weekly period.

Notably, ETH ETFs kicked off the week of Feb. 3–Feb. 7 with $83.54 million in inflows on Monday, but things really took off on Tuesday, jumping to $307.77 million after Eric Trump’s post: “It’s a great time to add ETH.” Right after, Ethereum skyrocketed over 35%, climbing from around $2,300 to over $2,900 in less than a day.

As reported by Crypto.news.

The Ethereum Foundation

There's a lot of conflicts within the foundation, and more of it(I think) can be figured out from these restructuring plans tweet by Vitalik.

Most of the issues appear to stem from the underperformance of ETH whilst the rest of the markets boomed during Bitcoin's recent surge to new ATH. That, in addition to the foundation’s non-transparent selling of ETH worth over $100 million yearly and questions of its leadership.

There's discontent in the ecosystem, and it's important to understand where it's coming from. The crypto market has been bullish overall in recent months, but ETH is underperforming compared to other assets. This naturally prompts the community to look for someone to blame, and the Ethereum Foundation is the obvious culprit. It bears the name Ethereum, it holds the trademark, it is highly visible... So many people are asking: "If ETH isn't rising, is it the foundation's fault?" And this criticism extends to the question of leadership, both externally and internally. Is the Foundation playing its role properly? Does it take the right decisions? And above all, is it communicating well about what it is doing?

There is also criticism of leadership. Its executive director Aya Miyaguchi has been in post since 2018, that's seven years. Wouldn't a renewal be a good thing?

Source: Thebigwhale

Market Surpression(Manipulation?)

Before Feb. 03 market crash, speculated to be influenced, in part, by Trump’s trade wars with tariffs, ETH has been in the major discussions as one of other top crypto assets being suppressed by market makers like Wintermute and centralized exchanges like Binance.

This was an event I wrote about, exactly 7 days ago.

Looking at all these events leading up to this day's growth in short sellers, there's a question amongst crypto investors and enthusiasts if ETH shorters are prompted by fear? conviction? Or market manipulation?

A growth of this scale is bound to trigger sell offs, even though traders could fear that a short squeeze might occur.

Speculations like this of course ignore that shorts can hedge their bets by buying spots, and they quite frankly could be running on low leverage, as low as 1x, especially if the primary goal is to manipulate the market and sweep up more ETH from panic sellers.

With over 19 million ETH on centralized exchanges, there's quite enough ETH for institutions to buy enough influence over Ethereum's consensus layer. The fact that its major protocol upgrades are agreed upon off-chain does not mean much if top validators decide to fork the chain.

I would say that this is a bottom signal, except the overall market decides to dump harder, by the hands of Bitcoin of course.

Ethereum being centralized is nothing new. Being the powerhouse for the programmable economy, something Bitcoin isn't, of course institutions are going to attempt racing each other to control it.

Think about it. Bitcoin takeover is planned because Bitcoin is the anchor asset holding down the ecosystem. Ethereum is like the engine, the sort-of economic layer and Solana is the Casino hub, what's there not to want? That's money, in billions. At this point, it doesn't matter who's after what, it's happening, and if you're an ETH holder, the best move will always be buy spot and avoid perps. Leverage is dangerous in this atmosphere.

Even the President of the United States is interested in ETH, what more proof does one need? Making money off it is quite feasible, it's being suppressed and strategically fudded for a reason but that's at the cost of any chance at being truly decentralized.

Ultimately, time will tell.

Posted Using INLEO

https://www.reddit.com/r/CryptoCurrency/comments/1imyid0/eth_shorts_hit_new_highs_fear_conviction_or/

The rewards earned on this comment will go directly to the people( @blkchn ) sharing the post on Reddit as long as they are registered with @poshtoken. Sign up at https://hiveposh.com. Otherwise, rewards go to the author of the blog post.