Does Bitcoin solve “the fee problem” in cross-border money transfers?

A random flaw of traditional finance is its reliance on intermediaries, which can lead to inefficiencies and high costs. Banks, brokers, and other financial institutions act as middlemen in transactions, often charging fees, delaying settlement times, and sometimes introducing risks like mismanagement or fraud. This centralized control can also limit accessibility, especially for people in underbanked regions.

This was ChatGPT’s response to a query that reads: Tell me a random flaw of traditional finance.

How crazy is it that the AI Chatbot's first line of thought was to snitch on the banking system on a query based on randomness?

Oh wait, traditional finance is nothing more than the banking system, and when you plug in all that data into a computer software to analyze, it's definitely going to sniff out the bullshit in a matter of seconds.

Some call it capitalism, others, like myself, call it unethical, and essentially an exploit loop enabled by the fraud that is the government.

Dominating an entire sector or industry should be a matter of consensus that it is logical and deserving, not a result of having money and political power. Capitalism needs limitations at some point, and this will be achievable when we crack decentralized governance.

The business of traditional intermediaries is an economic tax. People often will view these middle players as some sort of “security layer” set in place to prevent fraud and general movement of illicit funds but the reality is that these systems cost an awful lot whilst fraud grows still.

Traditional finance has a lot of problems and one of them is its fees. Given how regid the system is, by design, every step of the way costs a lot, especially when we look at it on a global level.

According to data, $857 billion were estimated to be sent in remittances in 2023.

Recent data from worldbank.org shows that remittances cost on average 6.65% of transaction value.

That's approximately $57 billion earned by intermediaries. Western Union is estimated to account for the facilitation of about 25% of remittances volumes.

Bitcoin vs Traditional Money Transfer Solutions

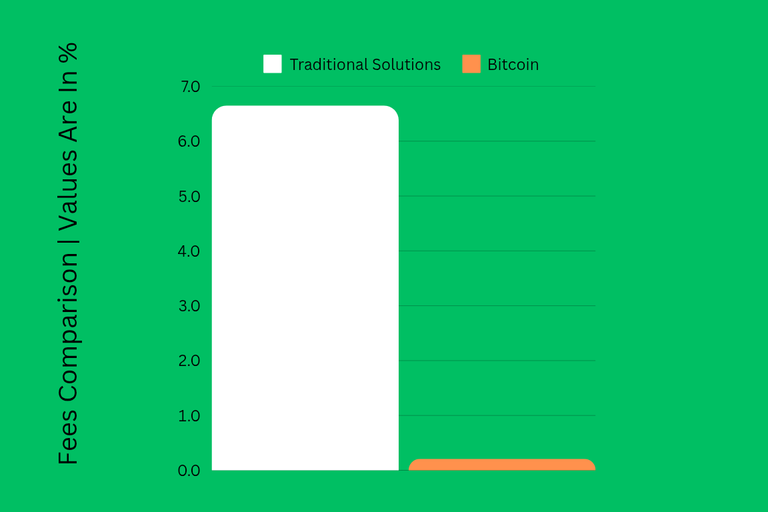

The chart above is a comparison of Bitcoin transaction costs vs remittances fees.

As seen above, remittance fees are as high as 6.65% whilst Bitcoin fees account for merely 0.21% of transaction value.

But we can't trust the data as it is because it is not truly reflective of actual costs, at least for Bitcoin specifically.

I had a hard time finding the necessary data to fully grasp the fee system associated with traditional money transfer solutions. With bitcoin, I only needed one blockchain data tracking source and everything was provable.

Traditional money transfer solutions are extremely costly. I have personally ditched many and gone fully into crypto payments.

It's a much more stressful process but the cost savings makes it worth it.

When you move money cross-border using traditional money transfer solutions, like Wise and Western Union, you essentially sign up to be exploited.

A couple of paragraphs above, I highlighted that intermediaries earned approximately $57 billion, there's a reason its said to be "approximate" as the real value is expected to be much higher.

This is because, despite the fact that these money transfer solutions charge fees that can theoretically decrease as volume increases, they are several other fee layers that extracts much more value.

A common example of this fee layer is the currency conversion markups, where these institutions apply hidden fees when trading between currencies, making the exchange rate much lower than the mid-market rate.

So imagine if a traditional money transfer institution charges just 0.75% for a transaction totalling $50,000 but with a -$0.06 markup fees.

This means that you'd receive $46,625 in whatever currency it's being converted to.

For every dollar converted, $0.06 is charged, bringing its total markup fee to $3,000 for a $50,000 transfer. That, in addition to the flat fee(0.75%) already attached to the transfer.

In comparison, moving your money cross-border with Bitcoin is a lot cheaper.

The network fee is currently $2.5 on average. In the last 24hrs, over $18.9 billion was moved through bitcoin and only approximately $40 million in fees were paid. This would have cost over $1.2 billion via traditional money transfer solutions.

That said, the fees on Bitcoin is much lower when you exclude the coinbase reward, otherwise referred to as "block subsidy or simply block rewards" — fees paid in the past 24hrs is just a little above $1.2 million, bringing the fee rate to 0.0065, percentage-wise.

Notwithstanding, whilst merely judging by current data, Bitcoin evidently appears to have solved the fee problem, we will have to see how it would perform without the coinbase rewards.

Merely looking at the rewards per block, we can assume that it is reflective of how much miners are willing to accept for processing bitcoin transactions.

Essentially, coinbase rewards are indirect fees paid by users by dilution. This means that in a scenario where the coinbase reward is no more, users will typically have to directly incentivize miners with higher fees.

Based on current block rewards values which is estimated to be $284k+, this would demand that the average fee per transaction is set to approximately $84.37.

In an event like this, Bitcoin would not be a suitable option for cross-border money transfers.

The flaw here is that fees on blockchain networks do not increase simply because one is transacting more. This sometimes sounds like a great thing, but it becomes a bad design because it burdens low-value transfers and enables big players enjoy less charges for moving millions to billions around.