Decentralized perpetual contracts hit $1.5t volume: we are a decade away from DEXs dominating trading volumes

$1.5 trillion of yearly Perpetual contracts trading volume now happens onchain and this is only recently just gaining traction despite being first introduced 5 years ago by dYdX.

A couple of days ago, I saw a tweet that insinuated that Binance might be trying to attack and kill off a particular decentralized perpetual trading solution and my honest reaction was that it wouldn't totally be a surprise if that was true.

We are in interesting times and there's a lot of emotions hitting new peaks within the cryptocurrency ecosystem, of course there's going to be a great deal of “conspiracy theories,” speculations, outright lies and extensive reporting on everything and anything.

Just a couple of weeks(months?) ago we were talking about market suppression and manipulation by Binance and Wintermute, a prominent market maker and now, we're exploring the idea that Binance might be trying to attack a decentralized Perps market?

Remember FTX? Yes, Bankman Fried Balls was a stupid gambler but we cannot ignore how CZ’s actions personally influenced how the market reacted. Just as it did with Luna, under Do Kwon in the not very distant time.

When Bybit got hacked and CZ made a tweet signaling support, I prayed for the ecosystem’s sake that Bybit was solvent enough because nothing was going to stop the ex-convict for fraud that happens to be praised from trying to take down a competitor.

So you see, I wouldn't doubt if Binance tried to use its liquidity and connections and try to attack a DEX solution that's a direct threat to its business.

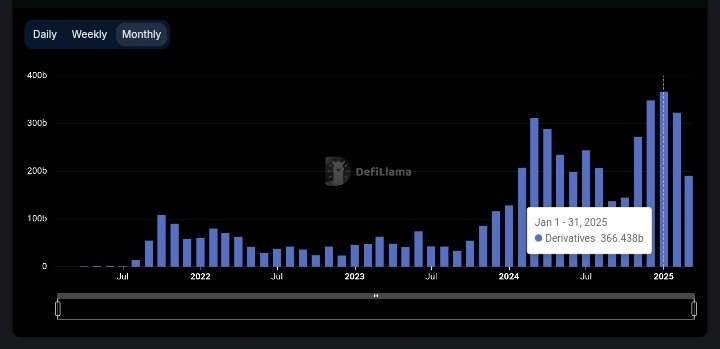

Decentralized Perpetual Futures Volume 2024: $1.5trillion

The top 10 Centralized Perpetual Exchanges recorded $21.2 trillion in trading volume in 2024 Q4, an increase of +79.6% from Q3’s figure of $11.8 trillion.

Total Volume on the Top 10 Centralized Perpetual Exchanges Hit $58.5T, Double Its Volumes of $28T in 2023, making it the most active perpetuals trading year ever.

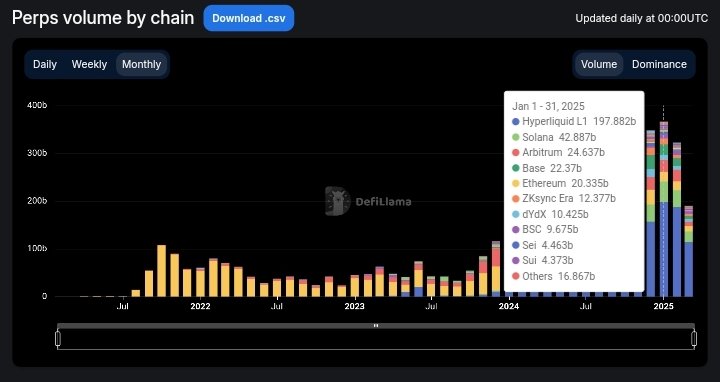

Total Volume on the Top 10 Decentralized Perpetual Exchanges Hit $1.5t, With Hyperliquid Accounting for More Than Half the Recorded Volume in 2024 Q4. — Coingecko report.

One thing that caught my eye in this report is that Binance lost a 9% market share in the same timeframe, which would explain why people would believe that it is out to destroy decentralized perpetual markets.

CZ about a months ago took a jab at decentralized spot exchanges, insinuating that they are not user-friendly and not fit for the market and that this was his first time ever using one and conclusively, the centralized exchange, Binance was better.

Whilst they may be some truth to what was said, everything is a marketing ploy, regardless of how it sounds. This would also prove that CZ is curious how these decentralized counterparts are gaining market traction and closing in on their volumes despite not being very user friendly.

Certainly, it has to cross his mind to think what would happen if that significantly improved. Well, that's what is likely to happen within the next decade as DEXs remain a highly funded segment of the ecosystem and the advent of stablecoins and payments solutions earning traction globally being a plus.

The top 10 Decentralized Perpetual Exchanges recorded $492.8 billion in trading volume in 2024 Q4, an increase of +55.9% from Q3’s figure of $316.2 billion. In total, the top 10 exchanges recorded $1.5 trillion in trading volume in 2024, a jump of +138.1% from 2023’s figure of $647.6 billion.

Hyperliquid (HYPE) was one of the major highlights in Q4, owing to its successful HYPE airdrop. It managed to capture more than 55% of market share in Q4, reaching a high of 66% in December.

Meanwhile, former market leader dYdX has seen a significant decline in market share throughout 2024. It declined from 73% in January 2023 to just 7% in December 2024.

And people say Airdrops are not great marketing strategies. The only reason I know of Hyperliquid is because of its recent airdrop and I believe that this is also the case for most of its over 473k users. Frankly shocked to discover that this has existed since 2023.

Easy to miss projects building great things early on when the media is always hyper-focused on shits immediately trending, always for the clicks and USDs.

As can be seen in the charts above from defillama.com, 2024 is the year volumes surged significantly and Hyperliquid happens to have dominated Q4 volumes as seen in the second chart.

It is absolutely beautiful to watch onchain solutions compete against centralized entities. It's also been reported that Hyperliquid generates nearly $1 Million in revenue per day.

Not a lot of unique and non-memecoin crypto projects pulling such numbers.

All we need is 10-20 more solutions like Hyperliquid(but better) and the onchain markets will dominate major assets trading volumes. Centralized exchanges like Binance know what is coming, it won't be long now before people start valuing truly owning and controlling their assets, whether when investing or when trading.

The future is onchain!

Posted Using INLEO