A Snap of Global Situation

Author: @aljif7

Platform: Hive

Date: 17 Tuesday 2025

Category: Finance-News

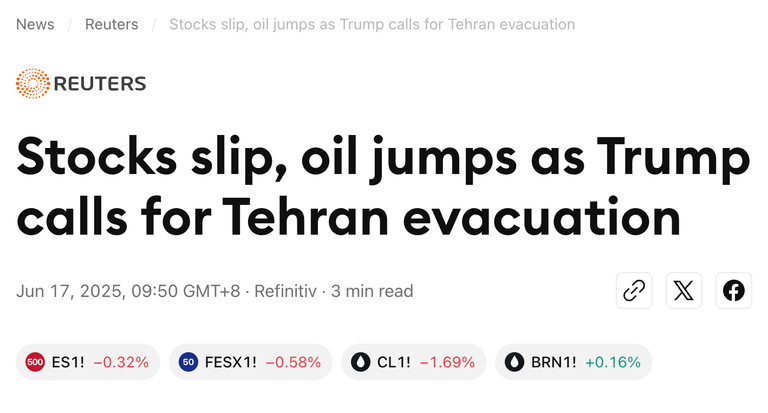

First hour of Hong Kong Stock Market is almost done and global situation is uncertain.

Geopolitical Tensions in the Middle East

Escalating Violence: The ongoing conflict between Israel and Iran has intensified, with significant strikes reported over the weekend. The UN's human rights chief has condemned the violence and called for a negotiated resolution to the crisis. In Gaza, aid workers are facing challenges due to disrupted mobile communications, complicating their efforts to provide assistance.

Market Reactions: As tensions rise, markets are reacting with increased volatility. Investors are gravitating towards safe-haven assets like gold, which has seen a price increase, while crude oil prices have also climbed due to fears of supply disruptions stemming from the unrest in the region.

Economic Outlook and Central Bank Decisions

Global Economic Slowdown: The global economic outlook has worsened, with growth forecasts being revised downwards. The OECD has lowered its growth projections to 2.9% for 2025, citing the adverse effects of trade tensions and policy uncertainty. This has raised concerns about inflation and the potential for further economic instability.

Central Bank Strategies: Central banks worldwide are navigating a complex landscape of economic challenges. The Bank of Japan is expected to maintain its interest rates while considering future bond tapering, reflecting a cautious approach to avoid market disruptions. Meanwhile, the Federal Reserve is anticipated to hold rates steady, with traders pricing in potential cuts later in the year.

Investor Sentiment and Market Dynamics

Risk Aversion: The current geopolitical climate has led to a wave of risk aversion among investors. U.S. stock futures have slipped, reflecting concerns over potential military actions and the broader implications for global markets. Analysts emphasize that the macroeconomic backdrop is particularly challenging, with multiple factors contributing to market uncertainty.

Focus on Economic Data: As central banks prepare for pivotal meetings, investors are keenly awaiting economic data that could influence future monetary policy decisions. The upcoming U.S. jobs report and developments in U.S.-China trade talks are particularly critical as they may shape market expectations moving forward.

This snapshot of the global situation highlights the intricate interplay between geopolitical events and economic dynamics, underscoring the challenges faced by investors and policymakers alike.

Brent Oil Price is 74.26 at the moment of this post.

That’s all for now my friends! Thank you for your support! Don’t forget: Engage, comment interact and we all grow here!

Enter the WEB3 Universe-InLeo: https://inleo.io/signup?referral=aljif7  Learn about BTC in Spanish: Cursos-videos relacionados con BTC y Criptomonedas:https://criptomonedastv.com/tienda/

X: aljif7

Facebook: https://www.facebook.com/profile.php?id=718459769

IG: https://www.instagram.com/aljif7/?hl=en

Academia de IA:https://academy.gptzone.net/?aff=AJIMENEZ

Cypto-Tips are welcome:

Some Satochis=BTC fraction: bc1q5qzx9cg3r88dp96jnx9hk4z8s8fpw3xuzsmatk

Lite-coin Fraction: LTC: MAt4qZUmz8hi6FEZVx1JvUKJxqy3YjBRnu

ADA: addr1qxeaxcansdg6cpk3zt6lthge9ftdme0l34k0eqyj4zgngycpyws7cy2senka3mjlft6a4udr6dfhxmhvd5fdf6mf5jnqczdnkl

AXS: ronin-Wallet: 0x33D171feD3Dc3D46E57273E2d104E57C2789b795

Posted Using INLEO