The Sky is Falling: Stock Markets, Past and Present. My Collage for LMAC #225

The Dow Jones Industrial average plummeted 7.86% this past week. I am not an investor. That is, I don't invest in the stock market. Not anymore. But, in a way, we are all investors. Even if we don't have a direct stake in the market, a dramatic fall such as we experienced in the last couple of days affects everyone. Unless we live in a cabin somewhere, off the grid, a dramatic economic downturn ripples through the economy.

If nothing else, a lot of people are going to be in a very bad mood as they watch their savings, in many cases their hope for a more prosperous future, take a dive.

I do know someone who made money in the last few days on the market. He's pretty savvy. He guessed (what else can you do with the market but guess) that it was pretty certain the markets would have a conniption if the U.S. imposed tariffs broadly. No one knew, of course, how broad the tariffs would be, but this young man figured the uncertainty in itself would be a blow.

So, how did he make money? He bet against the market. This is new to me, but you can actually buy a 'put', which is a contract to sell at a certain price. If a stock falls below that price, you make money. That's what he did. He bought 'puts' before the announcement and picked up a few bucks today after the market tumbled. Actually, I think he doubled his money.

This is why I don't invest. I don't substantially understand how this works. It seems like poker to me. A calculated gamble, but nonetheless still a gamble

People invest in the stock market, I believe, because they hope to beat inflation by tying their funds to an equity that rises in value as the economy grows. That's the theory.

A week like this week takes the stardust out of that vision.

Has the sky fallen? Does the rapid drop in the Dow Jones average have dire implications for the economy? Some economists think so.

How does this Dow Jones tumble compare to the past?

In 1929 the Dow Jones fell by 13% in one day. It is the verdict of most historians (though not all) that the market collapsed because the economy was sick...hyper inflated stock prices. Speculation was rampant and there were few controls on investor behavior. Banks, brokers, people in general were behaving badly and the balloon burst.

Crowds Gather Outside NY Stock Exchange, October 24, 1929

![Crowds_gathering_outside_New_York_Stock_Exchange[1].jpg](https://images.hive.blog/768x0/https://files.peakd.com/file/peakd-hive/agmoore/23wqpjeztqxzqumQqGdaivozffpSw5E97n2n3XaG3pY32YmTq9ym3D5xqG4sKrsARu8m1.jpg)

Associated Press. Public domain

Did the stock market collapse in 1929 cause the Great Depression? Or were both events symptoms of an underlying illness. In the popular mind (my mind) the two are linked forever.

Stock market 'crashes' in history tend to be linked to a period of subsequent economic decline. In 1873, for example, a stock market crash led to a panic (a run on banks) and a subsequent 'Long Depression'.

NY Stock Exchange Closes Its Doors on Members, September 20, 1873

![The_Great_Financial_Panic_of_1873_-_Closing_the_door_of_the_Stock_Exchange_on_its_members,_Saturday,_Sept._20th_LCCN99614016[1].jpg](https://images.hive.blog/768x0/https://files.peakd.com/file/peakd-hive/agmoore/23y8wfTEfbZG1jWsvMsRxUxobnghLyMq3DiQNsE1TNh3a4Ng3jVag8gxS7xP9V6rkrEhQ.jpg)

U.S. Library of Congress. Public domain

What happened in the last few days may be different from 'crashes' in the past. For one thing, those crashes were organic. That is, they grew out of the financial dynamic of the times. In this case, the fall in the Dow Jones was the result of one action, one nation taking what its leaders believed was 'corrective' action. This Dow Jones fall is rather unique in that way, so how do economists figure its long-term effects? I don't know.

We are all passengers on a train that is wobbling on the tracks. Are there long-term economic implications of that wobble? Has the sky fallen? Or has it just fallen for those who are directly invested in the market? Is this a crisis or a blip on the screen?

Stay tuned.

The sky may or may not be falling on the economy, but LMAC is looking forward, not up at the sky. We are a dynamic community, which means we respond to our environment. Many of our participants did not enjoy the monthly contest format, so we are returning to a weekly contest. Additionally, we will be rewarding SBI units to participants throughout the week.

We love what we do.

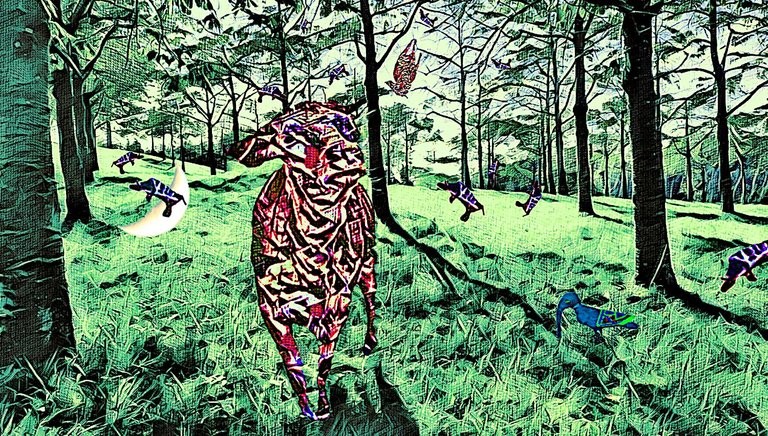

My collage this week (please note: I do not compete in the contest) was inspired not only by current events but also by the delightful template photo for this week's contest, courtesy of team member @quantumg.

It was really not very nice of me to mess around with that wonderful bovine, but after all this is art, and there are few rules in art :)

I borrowed from the LMAC image library, LIL as I created my collage. I thank @redheadpei, @muelli, and @yaziris for their pictures

Elements from LIL

Elephant head

LIL

@muelli

Pidgeon body

LIL

@yaziris

Moon

LIL

@redheadpei

I used GIMP, Paint, Paint 3D and a filter from Lunapic in order to make my collage. If you look closely you will note the elephant pigeon in the foreground:

This poor misbegotten creature is an expression of how I feel about the economic events of the week.

LIL and LMAC

LMAC is a welcoming community. We appreciate all sincere attempts to create art. I am not an artist, and will never be. However, creating is part of the human experience, one of the best parts. We invite everyone to discover the artist that lives inside each of us. Collage is the perfect medium for someone like me, someone who was never 'good' at art but who loves art.

Join us. If you are an artist, we rejoice in your talent. If you are not an artist, we also rejoice in your creative effort. Be original, be yourself and make something that speaks of you.

LIL is the library created by LMAC participants. We have about 14,000 images in the library. While this image resource was developed for LMAC collage creators, everyone on Hive is welcome to use it. Everyone may contribute to the library. Once images are part of the library they are in the public domain. Procedures for borrowing and contribution are described in @shaka's blog, here.

I hope the distress caused by this week's economic activities is short lived, and I hope it has not adversely affected my readers.

Peace and health to all. Hive on!

I can't remember details, but articles that explore the financials times around these events posit that they were anything but organic, but were instead manipulated by humans with great power, who then, like the man who used puts to make money, used these events to enrich themselves.

A lot of people are now reporting how much they have "lost" in the last two days. They seem unable to see how much they gained in the years leading up to today. It's very strange, and I do not want to know these figures, it's too easy for me to figure out how much they had, and still have, which are enormous gains over all. This is not the end of the world. Misbegotten creatures, more victim mentality, more conditioning.

Cool collage though, so there's that.

Thank you! I'm no artist but I do find expressing myself through collage stimulating.

As for the stock market: I don't play because I recognize my ignorance and powerlessness in that environment. There was one stock I bought for example. May husband and I put $1,000, a lot of money, but money we could afford to lose at the time. We watched passively as the value of that investment fell. $500, $200, $50 (!!!), then $0. The company declared bankruptcy. Shortly after that, it reorganized, same leadership and today is a thriving concern.

We are prey, my husband and I. Never would I argue with you about the sharks that swim in stock market waters.

I say kudos to the guy with the puts. He's not an investor. He's basically an outsider. He saw an opportunity and pounced. That's certainly the place to do it, if there is a place.

Thanks for reading.

Good for him, and many more of us could do this, but we are encouraged to get financial planners, who all tell their clients the same things. We can become unable to see opportunities if we allow someone else to tell us what to do with our money.

I, like you, tried it and decided it wasn't for me. I have exactly zero dollars in the stock market. To me, it makes no sense whatsover to have all your currency in only USD. Talk about diversifying is hollow. Talk about diversity is also hollow. Oh you've gotten me started.

We need a fallout shelter for our economic health.

My grandfather was a farmer, a well-known landowner in our upstate community. Didn't trust the banks. Wouldn't put his money in them, wouldn't borrow from them. Strictly cash, no debt.

He died a wealthy man.

Yes, I believe that. Banks are instruments of deception and slave systems. Of course. As are credit cards, which I no longer use. I stopped borrowing any money long ago, too. I have plenty, no one would call me wealthy I don't think, but I do not have to worry about money.

I don't know too much about all this either, but as far as I remember (my brain cells die quickly, it seems, short-term memory especially :)) we move in cycles. Now, whether it's a samsara going round in a vicious circle or a logarithmic spiral and we're going up slowly, but really slowly, I don't know.

But LMAC is an extraordinary community that allows us to express ourselves in some way, at least for me and probably for somebody else. There should be some loose rules, but they can be permanently changed if needed. Adaptation is a sign of communication and development.

I believe so. It's a community, and an art community to boot. All we have to do is pay attention, and respond appropriately.

Your feedback is always welcome, @seckorama (by me, anyway).

Great concept, @agmoore! The central figure of the cow, rendered in vibrant, almost chaotic hues of red and purple, seems to stand as a powerful metaphor — perhaps representing stability or sustenance, now fractured and distorted by the pressures of economic uncertainty.

I think, it is wonderfully creative to transform a cow, a crazy looking bird and some doves into such powerful symbols for events of our time. 👍

I know not too much about the stock market. My idea of what is happening there likely meets reality only a little. Whenever I hear too much news about it, I feel a strong urge to retreat into the woods. It makes me dizzy.

Isn't it incredible what a huge impact these things can have on the lives of people who have nothing to do with it?

Peace and health to you, too! 🤗

Thank you, my friend @quantumg. Yes< I wanted it to be jarring, disruptive.

I think a lot of us have that urge now. Events are always out of control, but this time it really does seem that the train is barrelling ahead with no one making good decisions. Let's hope that someone, something is able to get this thing right before a catastrophe ensues.

With that unpleasant thought aside, we turn to each of our little lives and try to just enjoy every day. Enjoy yours today, dear @quantumg.