"We Are Here"

If you take a peek at Bitcoin's all-time chart at this moment, it seems to be shaping a cup and handle pattern, a well-known bullish charting formation. But switch to the log view, and Bitcoin's chart appears even more bullish. I get it, the crypto community has been relatively subdued lately, lacking the buzz of excitement from a month or so back, but mark my words, the bull market ain't done yet.

Actually, the way I see it, the current price action depicted by the chart bears a striking resemblance to September 2020, just before BTC soared parabolically to $64,000. To me, that was the genuine peak, not the $69,000 spike. $69,000 was merely a failed attempt to lure the masses into pushing the price to $100,000.

They say third time's the charm, right? Well, call me optimistic, but I'm a firm believer that BTC will hit $100,000 this cycle. A $300,000 BTC seems a stretch to me, but $100,000? That's practically etched in stone. That's when the masses will truly start getting excited, tossing around targets of $1 million and beyond.

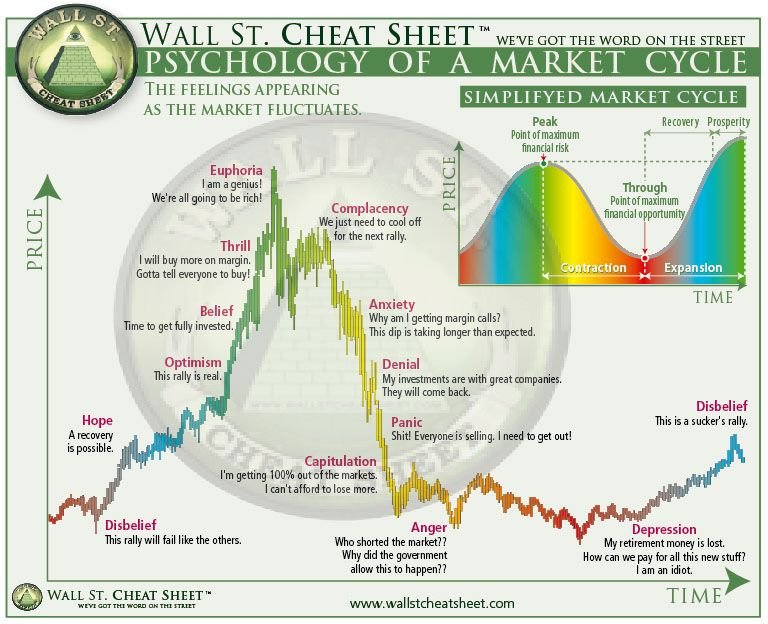

That's also when it's wise to start treading cautiously, gradually reducing exposure by pocketing profits. At least, that's my plan. Another intriguing chart I occasionally refer to is the WallStreet cheat sheet.

Right now, if you ask me, we're in the Optimism phase. We've traversed Disbelief during the banking crisis, felt Hope as some financial dinosaurs began stirring and BTC surpassed its previous ATH. Despite a minor setback, we're back in Optimism, largely propelled by institutional demand.

The likes of JPM and the Swiss Bank, Switzerland's largest bank, openly disclosing their holdings of Bitcoin ETFs, are certainly fueling hope. It suggests that retail investors are onto something, anticipating a shift, with the endorsement of the so-called smart money making it clear that crypto is here for the long haul. However, retail investors aren't entirely convinced we're heading to the moon just yet.

But mark my words, we will, and this final surge in the crypto market will be legendary. As we approach the elections, political candidates will capitalize on crypto's hype to attract more voters, while financial experts will tout Bitcoin (or even DOGE) as the future of currency, leading many to believe there's no turning back.

Once everyone is convinced it's a bull market, it'll be too late, and holding onto cash for a while will be the wisest move, in my opinion. Real estate will undergo its first significant correction in years, dragging down the SPX and reaffirming cash's reign, although by cash, I don't necessarily mean fiat money.

For me, HBD, USDT, and almost every other stablecoin suffice as cash. The more I witness examples of mass adoption, like those constantly shared by @3speak on Twitter, the more bullish I become about Hive thriving. At some point, I believe Hive will pave the way for a truly decentralized blockchain and the disruption we've been awaiting for years.

We're not done yet with this bull market. The best part is just around the corner. Enjoy the ride!

Thanks for your attention,

Adrian